Live Shows

Browse Shows:

Frontier Opening Bell - Thurs., April 25, 2024

Frontier Opening Bell - Wednesday, April 24, 2024

Frontier Opening Bell - Tuesday, April 23, 2024

Frontier Opening Bell - Monday, April 22, 2024

Frontier Opening Bell - Thursday, April 18, 2024

Frontier Opening Bell - Wed., April 17, 2024

Frontier Opening Bell - Tuesday, April 16, 2024

Frontier Opening Bell - Monday, April 15, 2024

Frontier Opening Bell - Friday, April 12, 2024

Frontier Opening Bell - Monday, April 8, 2024

ENERGY QUICKTAKES

Energy Quicktakes, April 23, 2024

Energy Quicktakes, April 22, 2024

Energy Quicktakes, April 10, 2024

Energy Quicktakes, March 27, 2024

Energy Quicktakes, March 25, 2024

Energy Quicktakes, March 22, 2024

Energy Quicktakes, March 19, 2024

Energy Quicktakes, March 13, 2024

Energy Quicktakes, March 05, 2024

Energy Quicktakes, February 29, 2023

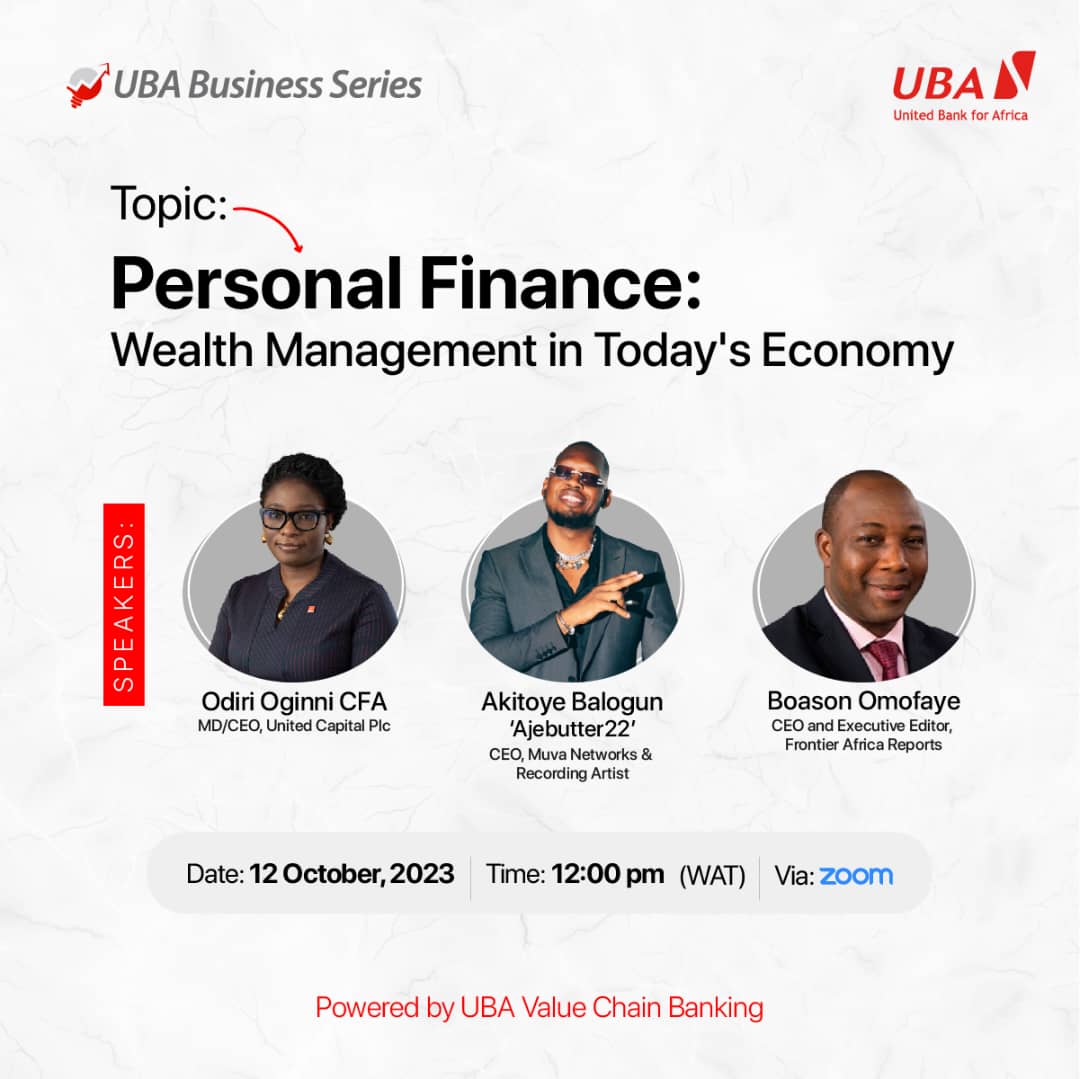

Frontier Africa Finance

Energy Frontiers

Energy Frontier-Episode 97

Energy Frontier-Episode 96

Energy Frontier-Episode 95

Big News for Zambia Hydro and Geregu Power as Saudi Arabia woos SSA - Episode 94

Oil Market Dynamics & Africa's Carbon Trading Future - Episode 92

Energy Frontiers-Episode 91

Zimbabwe Emerges as Energy Powerhouse with Second-Largest SSA Gas Discovery - Episode 90

IEA's 2024 Ministerial Meeting Sets Agenda for Global Energy Transitions - Episode 89

Energy Frontiers - Episode 88

Energy Frontiers - Episode 87

Energy Frontiers Episode 86

Energy Frontiers Episode 85

World Needs Triple Renewable Energy by 2030, says IEA | Energy Frontiers Episode 84

Can Oil Giants Go Green? Energy Voices of 2023 | Energy Frontiers Episode 83

The Future of OPEC as Angola Quits | Energy Frontiers - Episode 82

APPO Says No To COP28 Deal To Transition Away From Fossil Fuels | Energy Frontiers - Episode 81

Energy Frontiers-Episode 80

Energy Frontiers-Episode 79

Energy Frontiers-Episode 78

Energy Frontiers-Episode 77

Energy Frontiers-Episode 76

Energy Frontiers-Episode 75

Energy Frontiers-Episode 74

Energy Frontiers - Episode 72

Energy Frontiers-Episode 71

Energy Frontiers-Episode 70

Energy Frontiers-Episode 69

Energy Frontiers-Episode 68

Energy Frontiers-Episode 67

Energy Frontiers-Episode 66

Energy Frontiers-Episode 65

Energy Frontiers-Episode 64

Energy Frontiers-Episode 63

Energy Frontiers-Episode 62

Energy Frontiers-Episode 61

Energy Frontiers-Episode 60

Energy Frontiers-Episode 59

Energy Frontiers - Episode 58

Energy Frontiers-Episode 57

Energy Frontiers-Episode 56

SECURITIES MARKET FRONTIERS

Frontier Special Reports

Namibia International Energy Conference 2024

Capital Flows and Growth: Where in the money going?

Energizing Africa: What Will It Take to Accelerate Access & Improve Live..

Press Briefing: World Economic Outlook, April 2024

Seplat Energy Celebrates A Decade of Listing

Afreximbank Intra-African Trade Fair 2025 - Host Agreement Signing Ceremony

Afreximbank Annual Meetings 2024 - Host Agreement Signing Ceremony

Expanding Frontiers: Fiscal policies for innovation and technology diffusion

Expanding Frontiers: Fiscal policies for innovation and technology diffusion

Pre-Annual Meetings Press Conference 2024

294th MPC Briefing

Capital Market Pull-Out Ceremony In honour of Oscar N. Onyema OON, FCS.

NGX | IFRS FOUNDATION

FEDA Office Launch and Official Opening - Rwanda

Closing Gong Ceremony and Facts Behind Listing for Transcorp Power

293rd Meeting of the Monetary Policy Committee (MPC) Press Briefing

13th WTO Ministerial Conference - Opening Session

IEA 2024 Ministerial Welcome and Official Opening

IEA 2024 Ministerial Welcome and Official Opening