Sibanye-Stillwater lost R4bn in gold sales in three months

The latest quarterly report from Sibanye-Stillwater indicates that the group’s gold operations in South Africa suffered huge losses in its first quarter to end March 2022.

Gold production plummeted 47% to 4 264kg in the March quarter compared to 8 097kg the previous quarter. At the average price received – nearly R1 million per kilogram – Sibanye-Stillwater lost nearly R4 billion in income during the past three months.

The second quarter of the new financial year will be worse due to the ongoing strike.

Management noted that the lower gold production was more the result of stopping work at its Beatrix mine after a fatality and rehabilitation work at a tailings dam, rather than workers going on strike.

Production from the Beatrix underground operations only commenced in February 2022, following the suspension of all operating activities from December 3 2021 to address safety concerns.

The impact of the current strike is likely to only really be seen in the current quarter to end June. The strike that halted all work in the SA gold division started on March 9 and only affected operations for about two weeks in the first quarter as gold mines close their quarter a week or so before month end.

The ongoing strike has been affecting operations at Sibanye’s gold mines for six weeks into the current quarter. The strike has been going on for 61 days now.

Still striking

James Wellsted, executive vice president of investor relations at Sibanye-Stillwater, confirmed that there is no end in sight yet.

“As of today, the strike is still going on,” he said on Friday, after a meeting between the striking unions and the company did not yet resolve their differences.

“The unions have not accepted our revised offer. They have not budged in their demands,” said Wellsted, referring to Association of Mineworkers and Construction Union (Amcu) and the National Union of Mineworkers (NUM).

Two other unions, Solidarity and Uasa, accepted the company’s wage offer in February.

Sibanye increased its offer slightly on Friday, from R800 a total of R850 per month.

The two striking unions are still demanding an increase of R1 000 per month, although they have reduced their demand for a living-out allowance from R100 to R50 per month.

Wellsted said that the 24 000 striking workers have lost some R1.3 billion in wages since the start of the strike.

Sibanye calculated that each Category 4 employee has lost R33 672 in wages since the beginning of the strike 61 days ago while Category 8 employees have lost out on R41 724 each – for the sake of an extra R200 per month.

The reality is that even if the strikers get R200 more, it will take them more than 14 years to make up for what they lost in wages during the strike.

Sibanye maintains that, taking the interests of all stakeholders into account, its wage offer is fair.

“The high wage demand and resultant increase in costs will threaten the sustainability of some operations,” said Welsted, adding that some of the gold mines have only enough reserves to keep going for another 10 years.

An increase in operating costs will cut the production from lower grade areas as this will become unprofitable immediately. Viable ore reserves decline and reduces life-of-mine overall.

In an effort to persuade workers, Sibanye states that an entry-level employee earns a guaranteed income of R16 036 per month. This includes basic pay, holiday leave allowance, living-out allowance and contributions to a provident fund.

Huge loss

The results for the March quarter show that Sibanye has a valid argument about the profitability of its SA gold mining operations.

The gold operations reported income of R884 643 per kilogram of gold sold during the quarter ending December 2021, and all-in sustainable cost of R833 848 per kilogram. That leaves little profit, but enough as it produced eight tons of gold.

Production fell to less than 4.3 tons of gold in March, with the result that unit costs increased to R1.18 million per kilogram of gold produced.

Sibanye lost out on the benefit of the average gold price increasing to R916 351 during the quarter.

Performance of platinum operations

Meanwhile, the company’s platinum operations benefitted from uninterrupted production, higher platinum group metal prices, and good cost control. The platinum operations in SA and the US carried Sibanye-Stillwater.

“The strategic benefits of the group’s growth and diversification are evident in the solid financial performance delivered for the quarter,” remarked management in its review of the results for the quarter.

Total adjusted earnings before interest, tax, depreciation and amortisation (Ebitda) were even slightly better at R13.7 billion for the quarter after netting off the gold losses against the improved platinum profits.

“Restrictions relating to Covid-19 have reduced significantly in most of the world with the chip shortage affecting global auto production during 2021 alleviating during the quarter,” says management.

“The continued pursuit of a zero Covid strategy in China and the conflict in Ukraine, combined with the economic sanctions imposed on Russia, have, however, heightened economic uncertainty, resulting in significant commodity price volatility.”

So far, the environment has been good for platinum producers.

Sibanye-Stillwater notes that on an annualised basis, first quarter adjusted Ebitda equates to approximately R55 billion, well above the R49.4 billion of 2020 and not far short of the record of R68.6 billion for 2021.

Meanwhile the rand has decreased, with a benefit to profitability. The rand averaged R15.22 per dollar in the three months to end March, but declined to R16 per dollar last week. However, higher metal prices and a weaker currency are only beneficial if strikers return to work.

Share price

Shareholders are probably furious. The Sibanye-Stillwater share price fell by some 37% from above R75 at the beginning of March to the current R47.75 per share. It is not much higher than the low of R45 in September 2021.

In comparison, AngoGold Ashanti is more or less at the same level as at the beginning of March – less than 6% down at R310 compared to R330. The share is still well ahead of the low of R216 of September 2021.

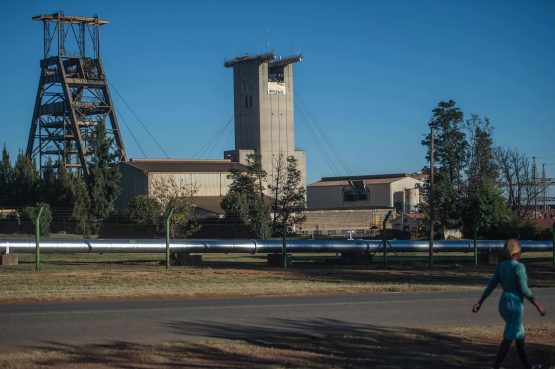

It is sad. Sibanye stepped in and bought all the SA gold mines when the mining houses of old had enough in an environment that sceptical investors will describe as toxic. They acquired rich mines like Kloof and Driefontein from Gold Fields and the then fairly new Beatrix from Gencor, and saved thousands of jobs.

As things are going now, the sellers (and sceptics) are being proven right.

Talks between the company and the unions representing striking workers continue on Monday, and one can only hope that they reach an agreement.