Regulator issues guidelines on virtual AGMs

The Capital Markets Authority (CMA) has issued guidelines to Kenyan listed firms wishing to hold their Annual General Meetings (AGMs) via electronic platforms.

This follows a Ministry of Health directive banning all public gathering as a measure to contain the spread of COVID-19.

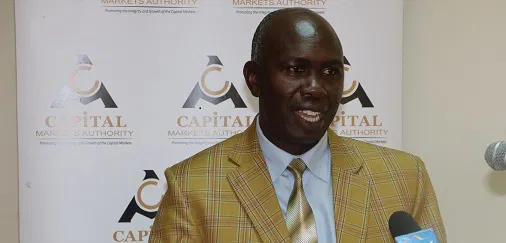

According to Mr. Wyckliffe Shamiah, Acting CEO of the CMA, the Circular applies to any listed firm that finds it impracticable to conduct a general meeting in the manner required by its articles of association.

This is in line with the Court Ruling while allowed companies listed on the Nairobi Securities Exchange to hold virtual AGMs, subject to CMA approval.

The listed firms are required to have a No Objection letter from CMA before issuing the notice to shareholders on the intended general meeting. The Authority must also receive details of how the meeting will be held, and demonstrate how requisite information will be provided to shareholders to enable them to make informed decisions.

Capital Markets Authority will process all complete applications received from listed firm within 14 days. Upon receipt of a no objection, issuers are at liberty to issue a 21-day statutory notice of the intended general meeting to its shareholders.

‘‘In order to protect the rights of all shareholders, we emphasize that all shareholders should be given ample time to raise their questions and receive explanations from the Directors and/or management’’,said Mr Shamiah.

The Authority says it will ensure that shareholders of these listed firms are provided with adequate information to help make informed decisions.

Mr. Shamiah has given the assurance that CMA has been working closely through joint strategies to enable business continuity and mitigate any disruptions. These measures include ensuring that the trading and settlement systems continue to function to support all transactions.

CMA has waived of the need for listed companies and market intermediaries to publish their financials in newspapers and instead use websites and social media channels.

It has also allowed Boards of listed firms to pay dividends and appoint auditors, agenda items whose determinations can later be ratified once AGMs are convened.