Investors Pile Into Africa Unconcerned About Virus Spreading

Investors are piling into African assets as if the coronavirus pandemic never happened.

Even as questions hang over whether governments in the region will be able to sustainably address the economic and health consequences of the pandemic, stock markets, currencies and bonds have been on a tear since at least the beginning of May. Investors are looking past the risks as unprecedented stimulus by governments and central banks around the world drives down the dollar and re-awakens the search for yield.

“We are back into the battle between central bank injections of liquidity and fiscal support by governments versus the uncertainty on the shape of any recovery,” said Hasnain Malik, the Dubai-based head of equity strategy research at Tellimer. “When even the most vulnerable stories are rallying, it is a measure of how tolerant risk appetite has become.”

Seven of the 12 top-performing developing-nation bond markets this quarter are in Africa. The list includes Angola, which leads the pack with a return of 81% compared with the 9.8% average of peers -- even though it’s in discussions to reorganize some of its loans.

Currencies like Ghana’s cedi and Zambia’s kwacha have recovered from record lows against the dollar, as has South Africa’s rand, whose 10% gain since the beginning of May is bested only by Mexico’s peso among emerging-market peers.

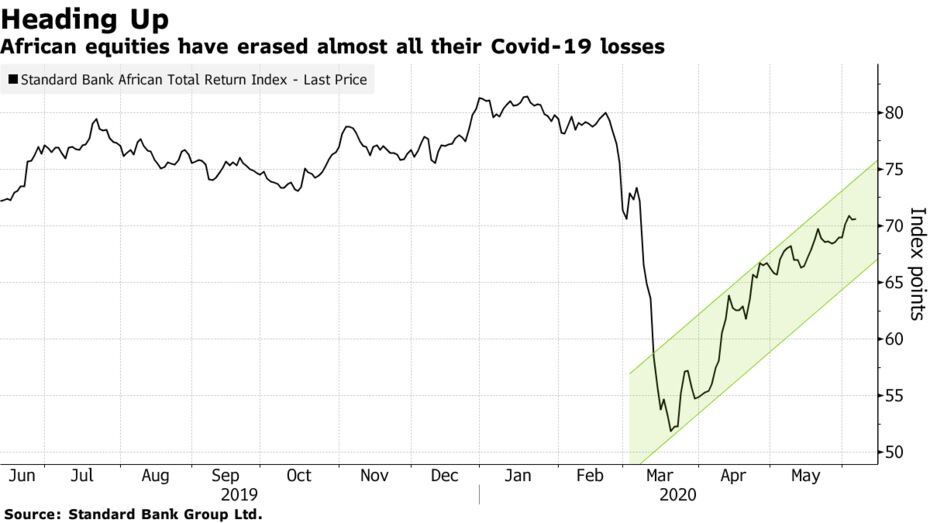

Stock markets have joined the party. South Africa’s benchmark index has led the pack with a leap of 44% from a low on March 19, while Namibia’s has climbed 41% and Nigeria’s 14%. Standard Bank Group Ltd.’s measure of African equities has rebounded 38%. That’s despite evidence that the worst of the pandemic is still to come in Africa, where a number of economies have eased restrictions aimed at preventing its spread.

While African countries are trailing their developed-market peers in infection rates, uncertainty reigns about the trajectory of the disease on a continent that doesn’t have the financial resources available to richer nations to counter the pandemic’s economic and medical effects.

The continent has confirmed 163,599 cases of the virus, according to the Africa CDC, less than 3% of the 6.6 million cases globally, and accounts for 1.2% of the 390,000 deaths. South Africa is worst-afflicted in Africa, with more than 40,000 cases and over 800 deaths as of Friday morning.

‘Premature Exuberance’

“Markets like to see that lockdowns worked in East Asia, Europe and the North-East of the U.S.,” said Charles Robertson, the London-based global chief economist at Renaissance Capital. “They seem prepared also to ignore rising cases in lower-income countries, where ineffective lockdowns have been dropped.”

The exuberance may be premature, considering the uncertainty around the nature, spread and potential prevention of Covid-19, Jacques Nel, an economist at Paarl, South Africa-based NKC African Economics. The lack of clarity about how the pandemic will affect individual economies should give investors pause for thought, he said.

“The pandemic could remain a severe problem from both a social and economic perspective for some time, but at the moment it is difficult to determine this with the limited information,” Nel said. “I suspect many investors are waiting for signs of how the crisis will impact different geographies, while at the same time taking advantage of much more attractive yields than those provided by less risky assets.”

As a result of inadequate stimulus, many African economies are positioned for an extended slump, not a rapid recovery, according to Bloomberg Economics. The six biggest African economies will see gross domestic product contract by an average of 4.5% this year. That suggests markets could be in for pain once the current rally has run its course.

“We have a stable to positive outlook on most African currencies right now, but we are wary of over-exuberance in the markets,” said Michael Nderitu, the Nairobi-based chief risk officer at AZA. “In some markets investors seem to be almost blind to the risks and are buying like there’s no pandemic.”