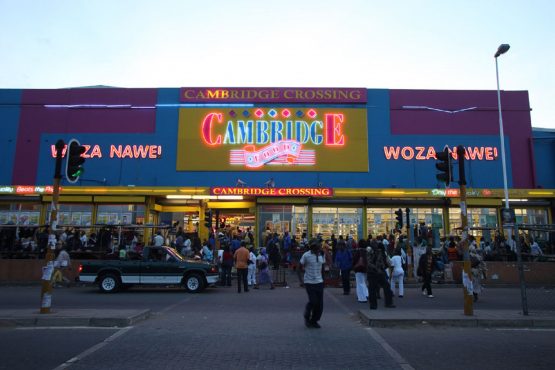

CompCom backs Massmart’s R1.36bn sale of Cambridge and Rhino to Shoprite

Struggling JSE-listed retailer and wholesaler Massmart is closer to banking R1.36 billion after the Competition Commission (CompCom) on Friday backed the sale of the group’s loss-making Cambridge and Rhino chains (and related food businesses) to its much bigger listed peer Shoprite.

The CompCom said in a statement it has recommended to the Competition Tribunal that it approve the proposed acquisition by Shoprite Supermarkets, however the deal is “subject to competition and public interest conditions” such has no job losses.

The deal, which was first announced in August last year, will unlock valuable funds for Massmart to either invest in its turnaround strategy or bring down its debt.

Retail, wholesale and more

The merger will see 56 retail grocery stores and 43 retail liquor stores added to Shoprite Supermarket’s chain of over 500 stores in the country (the broader Shoprite Group has over 1 500 stores in the country under the Shoprite, Checkers, OK and other brands).

Included in the deal are 10 wholesale (Rhino Cash & Carry) stores, two wholesale liquor stores, Massfresh (a meat processing and packing facility) and Fruitspot (a fresh fruit and vegetable processing facility).

According to the CompCom, the merger does not raise any competition or public interest concerns in the wholesale of grocery products.

This includes commitment to a “package of public interest remedies” that pledge:

No job losses due to the merger;

The implementation of an employee share ownership scheme;

Shoprite Checkers significantly increasing local procurement and investing in skills development;

Shoprite Checkers to continue procurement of “target business” (Cambridge and Rhino) suppliers; and

Developing and supporting SMME (small, medium and micro enterprises) and HDP (historically disadvantaged persons) retailers, suppliers and other small businesses in their value chain.

The CompCom said its investigation found that national retail grocery chain competitors of Shoprite Group are other national chains, including the “target business” (Cambridge and Rhino), Pick n Pay, Spar and Woolworths. The commission noted a lack of evidence pointing to direct competition between small/regional retailers and national retail grocery chains.

According to the commission, the merger will increase concentration in retail supply of groceries by national grocery chains. This, according to the CompCom, is qualified by the limited number of stores in the target business.

It said that apart from the merging parties, there are only two other national players that target low-income customers based on their product range, locations, price points and promotions. However, it found that the merger might raise competition concerns in national retail supply of grocery products and in specific local market areas.

“The commission found that although there were other bidders for the target business absent from the merger, the target business is likely to close due to its financial performance,” it said.

“The target business is considered non-core by Massmart, hence Massmart’s decision to dispose of the target business in its entirety,” it added.