Anglo Platinum hits that sweet spot at halfway stage

The group achieved record Ebitda of R63.3 billion – a 385% increase. Image: Philimon Bulawayo, Reuters

With results like these, Anglo Platinum executives must be smiling ear to ear.

This is especially true of newly appointed CEO Natascha Viljoen, who couldn’t ask for a better debut at the helm of the world’s largest PGM (platinum group metal) producer.

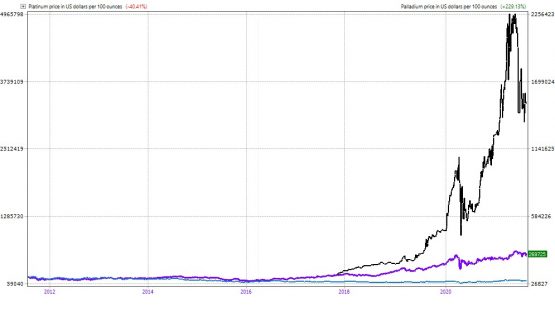

It helped that PGM prices, particularly rhodium and palladium, broke new all-time highs. The average achieved PGM basket price increased by 47% year-on-year to $2 884 per PGM ounce.

Listen: PGM miners making super profits

Rhodium and palladium set new all-time highs of $30 000 and $3 000 per ounce, respectively, while platinum hit a six-year high above $1 300 per ounce.

Rhodium and palladium prices have eased since setting new all-time highs earlier this year, on the back of surging demand from the auto sector. Prices were nudged higher by Covid-related shutdowns earlier in 2020. Though rhodium accounts for roughly 10% of PGM production in South Africa, it now makes a huge contribution to bottom line performance for most producers.

Refined production (excluding tolling) increased by 128% to 2.3 million PGM ounces, buoyed by the recommissioning of the Anglo Converter Plant in February last year following an explosion. In December last year the group announced that the plant was up and running again, slightly ahead of schedule, and that it would take two years to clear the work-in-progress inventory accumulated as a result of the plant stoppage.

“We remain on track to refine the remaining built-up work-in-progress inventory over the next 18 months,” says the group’s interim results statement. “The rebuild of the ACP Phase B unit is making good progress and is on track to be completed in the third quarter of 2021.”

Total PGM production from Amplats’s own mines increased by 29% year-on-year to 1.4 million ounces (H1 2020: 1.08 million ounces), assisted by the relaxation of government-imposed Covid lockdowns in early 2020.

Net sales revenue increased by 155% to R107.5 billion (H1 2020: R42.2 billion), mainly driven by robust PGM prices, and higher production and sales.

PGM production forecasts for the full year range from between 4.2 million and 4.4 million PGM ounces, due to lower third-party receipts and the continuing impact of Covid-19 infection rates on production. Refined PGM production (excluding tolling) is expected to reach 4.8 million to five million ounces.

Unit costs per PGM ounce are expected to range between R12 000 and R12 500, about 9% higher than previously expected due to the continued impact of Covid-19 on operations and the sharp rise in inflationary increases experienced during the first half of the year on consumables, which is expected to continue in H2 2021.

Total capital expenditure guidance, excluding waste stripping, remains unchanged at between R7 billion and R7.5 billion.

Viljoen says among the key focus areas going forward, Anglo Platinum will explore new markets while capturing value from adjacent value chains, while building resilience to help the organisation power through major disruptions.

Listen to this SAfm Market Update podcast with CEO Natascha Viljoen, on Amplats’s record dividend

Highlights

29% increase in the PGM basket price to R41 400 per ounce sold (H1 2020: R32 166)

Record Ebitda (earnings before interest, tax, depreciation and amortisation) of R63.3 billion, a 385% increase

Return on capital employed increased to 207% (H1 2020: 48%)

Net cash position of R57.6 billion (including the customer prepayment)

Interim dividend declared of R175 per share, or R46.4 billion, equating to 100% of headline earnings.

Community share schemes to receive approximately R245 million in respect of H1 2021 dividends.