According to the latest CipherTrace report, Uganda has the strongest and best KYC standards in all of Africa for crypto companies.

A new report by the blockchain analysis firm, CipherTrace, shows that 72% of African domiciled crypto assets exchanges and services are registered in the Seychelles and, 70% of those Seychelles-domiciled exchanges and services have bad or porous KYC.

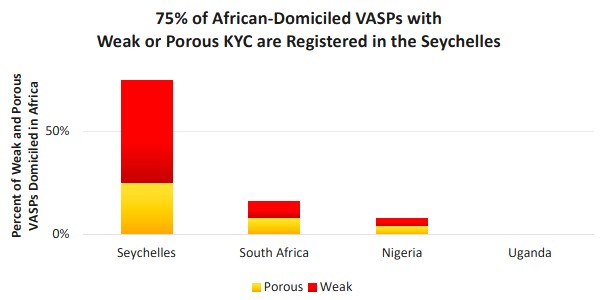

Fully 75% of all of Africa’s KYC deficient exchanges, then, are domiciled in the Seychelles, making the small island country a boon for potential money launderers. Further analysis shows that a majority of the customer base for Seychelles-domiciled exchanges are foreign users, highlighting their money laundering potential.

Below is a breakdown of the top African countries with registered VASPs known to have weak or porous KYC:

- Seychelles – Weakest KYC practices in Africa at 75%

- South Africa – Approx. 20% weak

- Nigeria – Approx. 15% weak

- Uganda – Strongest KYC practices in Africa

The report further notes that 56% of virtual asset service providers (VASPs) globally have weak or porous KYC processes. This means thatt money launderers can use these services to deposit and withdrawal funds with minimal to no KYC.

Below is a breakdown of the 2020 report findings:

- Globally, 56% of VASPs have weak or porous KYC in 2020

- 65% of the 120 most popular crypto exchanges had weak KYC in 2019

- 60% of European VASPs have weak or porous KYC

- 40% of UK exchanges have weak KYC

- 44% of US exchanges have weak KYC

- 80% of Russian exchanges have weak KYC

- 60% of the top 10 worst KYC countries in the world are in Europe

- DeFi, due to its permissionless and borderless design, has the potential to become a haven for money launderers

- 90% of Decentralized Exchanges (DEXs) with a clearly domiciled country have deficient KYC

- 85% of VASPs with no domiciled country have weak or porous KYC

- 72% of African-Domiciled VASPs are registered in the Seychelles

- 75% of Africa’s deficient VASPs are domiciled in the Seychelles

- 70% of Seychelles-domicled VASPs have bad or porous KYC

- Uganda has the strongest and best KYC standards in all of Africa

Strong KYC processes are important for both financial institutions and VASPs in order to identify customers and prevent bad actors from registering with fake credentials. As a result, it helps mitigate money laundering and reduces the chances of certain jurisdictions from becoming criminal havens or using VASPs as mixing services in order to sever ties to dirty money or previous flow of questionable funds.

In September 2020, the Financial Action Task Force (FATF) released a Virtual Assets Red Flag Indicators of Money Laundering and Terrorist Financing Report which warned that criminals are taking advantage of ‘jurisdictional arbitrage’ and exploiting gaps in AML/CFT regimes by moving illicit funds to VASPs domiciled in jurisdictions with non=existent or minimal AML/CFT regulations.

The FATF red flags are intended to help national authorities, VASPs, and the public sector to detect whether virtual assets are being used for criminal activity. These are available here: